Tax Assessment

OffRoad GIS provides support for both traditional assessment models as well as tax equalization schemes built on complex soils-based assessments for agricultural parcels. For traditional tax assessment, OffRoad GIS accommodates the separation of land assessment from structure assessment. In addition, OffRoad GIS provides automated tracking for any changes that may occur to any of the assessed values to accommodate year-end reporting requirements. Essentially, the automated tracking of valuation changes makes state reporting requirements a simple point-and-click operation.

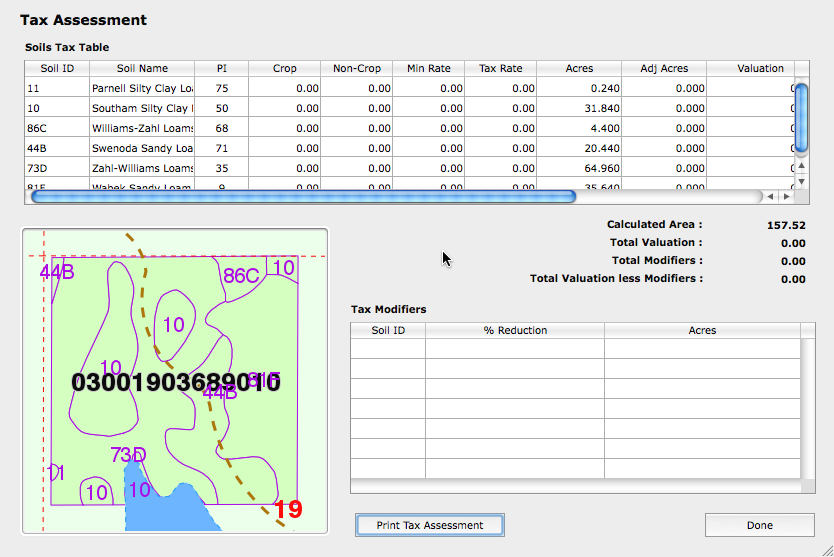

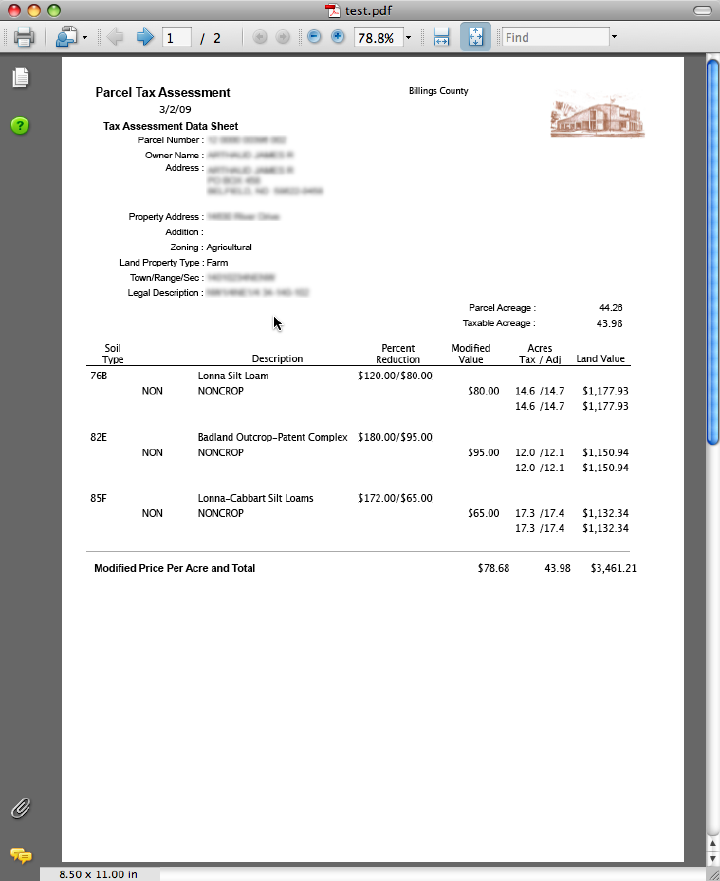

While the assessment of agricultural parcels has been complicated by the recent requirements to include soils and land use, OffRoad GIS essentially eliminates most of these complications and ultimately simplifies this process. OffRoad GIS addresses these issues through the integration of the following features:

- Current soils coverage is maintained within the spatial services engine.

- A soils lookup table is automatically generated from the soils coverage with tools to assign productivity indices to each soil type.

- Tax modifiers are developed and maintained independent of individual parcels to provide seamless management of land use features that impact agricultural productivity.

Background

"During the 2007 legislative session the North Dakota Legislature approved, and the Governor signed, House Bill 1303, which changes the provisions of North Dakota law dealing with the valuation and assessment of agricultural lands. The changes became effective January 1, 2007." . . . .

"The changes made by the 2007 mandate essentially require each county to assess the value of their agricultural land by assigning a fixed value to soil types contained within each land parcel, applying approved price modifiers where necessary, and, lastly, accounting for the actual use of the land. Counties that fail to implement this valuation method for any taxable year after 2009 will lose 5% of their state aid distribution each month until those counties have fully implemented the soil valuation process."

-- Source ND Association of Counties

By integrating the various processes into the spatial engine, OffRoad GIS has turned the soils delineation into a dynamic process that is automatically updated anytime the geometry of a parcel is changed or if any of the soils or associated productivity values assigned is changed.

As a result, an up-to-date assessment of your agricultural parcels is available anytime as a simple point-and-click process. You don't need to be concerned with the complex GIS operations to produce the necessary soils and parcel layers for purposes of developing your tax assessment on agricultural parcels. In the end, OffRoad GIS makes it easy to accomplish the goals established by House Bill 1303 without the on-going headaches of keeping these processes current.